Blockchain Payment Solutions Revolutionizing Transactions

Blockchain Payment Solutions takes center stage as one of the most transformative innovations in the financial landscape today. By leveraging blockchain technology, these solutions have emerged as a robust alternative to traditional payment systems, offering enhanced security, speed, and cost-effectiveness. The evolution from conventional banking to blockchain-based solutions marks a significant shift, promising a future where financial transactions are more transparent and accessible to everyone.

In this era of digital transactions, understanding the intricacies of blockchain payment solutions becomes essential. From the unique features that set them apart from traditional methods to the myriad types available in the market, this overview will guide you through the landscape of blockchain payments, highlighting their advantages, challenges, and future trends.

Introduction to Blockchain Payment Solutions

Source: imgur.com

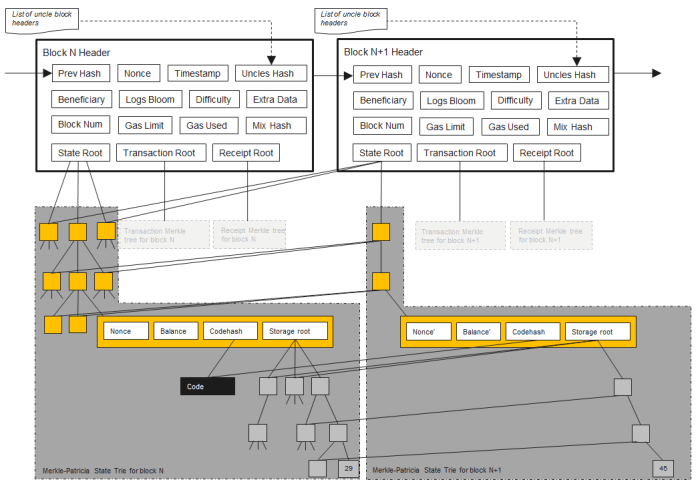

Blockchain technology has emerged as a groundbreaking approach to payment systems, revolutionizing the way transactions are processed and validated. By leveraging a decentralized ledger, blockchain enhances transparency, security, and efficiency in financial dealings. The transformation from traditional payment methods to blockchain-based solutions marks a pivotal moment in the evolution of financial technology.The evolution of payment solutions has seen a shift from cash and checks to digital transactions, culminating in the rise of blockchain.

In recent years, cryptocurrencies like Bitcoin and Ethereum have brought blockchain into the mainstream. This decentralized approach not only simplifies the transaction process but also reduces reliance on intermediaries, making payments faster and more cost-effective. As the demand for more secure and efficient payment systems grows, blockchain stands out as a leading solution in the financial sector.

Benefits of Using Blockchain for Payment Transactions

Blockchain offers numerous advantages that make it an appealing choice for payment transactions. The following points highlight the key benefits of utilizing blockchain technology in payment processing:

-

Enhanced Security:

Transactions made through blockchain are cryptographically secured, reducing the risk of fraud and unauthorized access.

-

Lower Transaction Costs:

By cutting out intermediaries such as banks, blockchain reduces fees associated with traditional banking systems.

-

Faster Transaction Speeds:

Blockchain enables near-instantaneous transfers across the globe, far surpassing the speed of conventional banking methods.

-

Increased Transparency:

The decentralized nature of blockchain allows all participants to view transaction histories, fostering trust among users.

-

Global Accessibility:

Blockchain payment solutions can be accessed by anyone with internet connectivity, making them available to underbanked populations.

The advantages of blockchain extend beyond mere cost and speed; they also encapsulate a shift towards more equitable financial systems. As businesses and consumers continue to adopt blockchain technology for payments, its impact on the financial landscape will likely grow, creating more opportunities for innovation and collaboration in the payments industry.

Key Features of Blockchain Payment Solutions

Source: ac.uk

Blockchain payment solutions come with a range of distinct features that set them apart from traditional payment methods. These innovations contribute to enhanced efficiency, security, and transparency in financial transactions. Understanding these key features helps businesses and consumers appreciate the value of adopting blockchain technology for their payment needs.

Core Features Distinguishing Blockchain Payment Solutions

The core features of blockchain payment solutions revolve around several technological advancements that offer superior benefits compared to conventional systems. These include:

- Speed and Efficiency: Blockchain transactions can be executed in real-time or within a few minutes, significantly faster than traditional bank transfers, which may take several days, especially for international payments.

- Lower Transaction Costs: By eliminating intermediaries, blockchain reduces fees associated with processing payments, making transactions more cost-effective for users.

- Transparency: Every transaction on a blockchain is recorded on a public ledger, providing visibility and traceability for all parties involved, which can enhance trust and accountability.

- Smart Contracts: These self-executing contracts automate and enforce agreements, reducing the need for manual interventions and speeding up processes.

Security Measures in Blockchain Transactions

Security is a paramount concern in any payment solution, and blockchain technology excels in this area through its unique mechanisms. Key security measures include:

- Encryption: Transactions are secured using cryptographic algorithms, ensuring that data is protected against unauthorized access.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted, providing a permanent and tamper-proof record.

- Consensus Mechanisms: Various consensus algorithms (like Proof of Work and Proof of Stake) validate transactions, preventing fraud and ensuring that only legitimate transactions are added to the blockchain.

- Decentralization: The distributed nature of blockchain means that there is no single point of failure, making it more resilient against attacks.

Decentralization Enhancing Payment Solutions

Decentralization is a fundamental characteristic of blockchain technology that greatly enhances payment solutions. Unlike centralized systems, which rely on a single authority or entity to control transactions, blockchain operates on a distributed network of nodes. This structure offers several advantages:

- Increased Control: Users have greater control over their funds and transactions without reliance on banks or financial institutions.

- Reduced Risks of Fraud: The decentralization reduces the potential for fraud, as no single entity can manipulate the transaction history or access funds.

- Access for the Unbanked: Blockchain payments can provide financial services to individuals who do not have access to traditional banking systems, promoting financial inclusion.

Types of Blockchain Payment Solutions

Blockchain technology has revolutionized the way payments are processed, providing immense potential for faster, secure, and cost-effective transactions. Different types of blockchain payment solutions have emerged, catering to various needs of businesses and individuals alike. Understanding these solutions can help stakeholders choose the best framework for their specific requirements.The blockchain payment landscape can be broadly categorized into public and private blockchain payment systems, each with unique characteristics that make them suitable for different applications.

Public blockchains are open and decentralized, allowing anyone to participate and verify transactions, while private blockchains offer controlled access and are typically managed by a single organization or consortium.

Overview of Blockchain Payment Solutions

Several blockchain payment solutions cater to different market segments and functionalities. Below are key types of these solutions:

- Cryptocurrency Payment Gateways: These platforms facilitate the acceptance of cryptocurrencies like Bitcoin, Ethereum, and others. They help businesses integrate crypto payments into their existing systems, enhancing customer convenience.

- Decentralized Finance (DeFi) Platforms: DeFi solutions leverage blockchain to recreate traditional financial systems, offering services such as lending, borrowing, and trading without intermediaries.

- Cross-Border Payment Solutions: These services simplify international transactions by using blockchain to reduce costs and enhance efficiency, making cross-border payments faster and more transparent.

- Stablecoins: Stablecoins are cryptocurrencies pegged to a stable asset, like the US Dollar. They provide the benefits of blockchain while minimizing volatility, making them ideal for transactions.

Differences Between Public and Private Blockchain Payment Systems

Public and private blockchains serve different needs and have distinct operational mechanisms.

Public blockchains are decentralized and permissionless, allowing anyone to join and contribute, while private blockchains are centralized and permissioned, requiring authorization to access.

- Public Blockchains: These are open to anyone, allowing for high transparency and security. They are ideal for applications requiring decentralization and trust, such as cryptocurrencies. Examples include Ethereum and Bitcoin.

- Private Blockchains: These are restricted to certain users, providing better control and privacy. They are often used in enterprise solutions where data confidentiality is paramount, such as supply chain management. An example is Hyperledger Fabric.

Popular Blockchain Payment Platforms

There are several blockchain payment platforms that are gaining traction for their innovative features and use cases. Below is a table outlining some of the most notable:

| Platform | Key Features | Use Cases |

|---|---|---|

| Coinbase Commerce | Easy integration, multi-cryptocurrency support, automatic conversions | Online retail, e-commerce transactions |

| Ripple | Fast cross-border payments, low transaction costs, partnerships with banks | International remittances, bank transfers |

| BitPay | Invoice generation, multi-currency exchange, settlement in local currency | Retail payments, online services |

| Stellar | Low-cost transactions, support for multi-currency, focus on inclusivity | Microfinancing, cross-border payments |

Advantages of Using Blockchain for Payments

The adoption of blockchain technology in payment systems has introduced significant advantages, transforming traditional banking and payment methods. This section explores the key benefits that blockchain offers, including cost-effectiveness, transaction speed, and the potential for enhancing cross-border payments.

Cost-effectiveness of Blockchain Payment Systems

Blockchain payment systems reduce the reliance on intermediaries, which often leads to lower transaction fees. Traditional banking systems typically impose various charges for processing payments, especially for international transactions. In contrast, blockchain transactions can significantly diminish these costs due to their decentralized nature.

Implementing blockchain can lead to transaction fees as low as 1% or even less, compared to traditional banking fees that can be upwards of 3% or more.

Furthermore, blockchain technology eliminates the need for currency conversion fees in many cases, as multiple currencies can be exchanged directly on the blockchain. This functionality not only enhances cost-effectiveness but also encourages more enterprises to adopt blockchain solutions for their payment processing needs.

Transaction Speed Improvements

One of the standout features of blockchain technology is the speed of transactions. Traditional banking systems can take several days to process payments, particularly for international transfers, due to the involvement of multiple banks and regulatory checks. With blockchain, transactions can be completed in real-time or within a few minutes, regardless of geographical boundaries. This rapid processing time ensures that funds are transferred quickly and efficiently, improving cash flow for businesses.

The average transaction time on a blockchain network can be as low as 10 minutes, compared to the several days typical of conventional banking systems.

This improvement not only benefits individuals but also enables businesses to operate more agilely, enhancing overall productivity and responsiveness to market demands.

Cross-border Payment Potential, Blockchain Payment Solutions

Blockchain technology is particularly advantageous for cross-border payments, providing a streamlined solution to the complexities often associated with international transactions. Traditional cross-border payments are fraught with high fees, long wait times, and various regulatory hurdles. By utilizing blockchain, businesses can engage in direct transactions, bypassing many of the conventional barriers. The decentralized nature of blockchain reduces the dependency on intermediaries, thereby lowering costs and increasing efficiency.

Blockchain technology can facilitate cross-border payments in under an hour, a stark contrast to traditional methods that can take days.

Moreover, blockchain networks can provide enhanced security and transparency, allowing both parties to view the transaction history and status in real-time. This transparency builds trust and can significantly reduce the risks of fraud and chargebacks, making it a more reliable option for global commerce.

Challenges and Limitations of Blockchain Payment Solutions

As promising as blockchain payment solutions are, they are not without their challenges and limitations. In the rapidly evolving landscape of digital finance, various factors can hinder their widespread adoption and effectiveness. This section delves into some of the significant obstacles facing blockchain payment systems today, including regulatory hurdles, scalability concerns, and issues related to user adoption.

Regulatory Challenges

Blockchain payment solutions often encounter a complex regulatory environment that varies significantly by region. Governments and regulatory bodies are still trying to understand and establish frameworks for cryptocurrencies and blockchain technology. Key regulatory challenges include:

- Lack of Standardization: Different countries have divergent regulations regarding cryptocurrencies, leading to confusion for businesses and users. This inconsistency can create barriers to entry for companies wanting to offer blockchain payment solutions.

- Compliance Requirements: Blockchain solutions must navigate anti-money laundering (AML) and know your customer (KYC) regulations, which can be cumbersome and costly. Failure to comply can result in significant penalties.

- Tax Implications: The treatment of cryptocurrencies for tax purposes is often unclear. Different jurisdictions may classify cryptocurrencies as property, currency, or something else entirely, complicating tax compliance for users.

Scalability Issues

Scalability remains a critical concern for blockchain payment solutions, particularly as transaction volumes grow. Many blockchain networks struggle to handle a large number of transactions quickly and efficiently. The following points highlight the scalability issues:

- Transaction Speed: Popular blockchain networks like Bitcoin and Ethereum have faced congestion, resulting in longer transaction times. For instance, Bitcoin can process around 7 transactions per second, while Ethereum can handle approximately 30 transactions per second, which pales in comparison to traditional payment networks like Visa, which can process thousands.

- Network Fees: As transaction volumes increase, so do the fees. High network fees during peak times can deter users from utilizing blockchain payment solutions. For example, in 2021, average Ethereum transaction fees spiked to over $40 during peak demand.

- Energy Consumption: Many blockchain networks, particularly those using proof-of-work consensus mechanisms, face criticism for their high energy consumption. This not only raises environmental concerns but can also limit scalability as operational costs rise.

User Adoption Concerns

While blockchain technology offers numerous benefits, user adoption remains a challenge. Some of the key concerns influencing user adoption include:

- Complexity of Use: Many blockchain payment solutions require a certain level of technical understanding, which can be intimidating for non-technical users. The process of setting up wallets, managing private keys, and executing transactions can be cumbersome.

- Lack of Trust: The volatile nature of cryptocurrencies and the prevalence of scams can lead to skepticism among potential users. Concerns about security and fraud deter many individuals from adopting blockchain payment methods.

- Limited Merchant Acceptance: Despite the increasing number of businesses accepting cryptocurrencies, many consumers still face limited options for spending their digital assets. This can lead to a lack of motivation to adopt blockchain payment solutions.

Future Trends in Blockchain Payment Solutions

As blockchain technology continues to evolve, its impact on payment solutions is poised to grow significantly. The integration of innovative features and the adaptation of existing models will shape the future landscape of financial transactions. Understanding these potential developments is essential for businesses and consumers alike.One of the most notable trends is the increasing adoption of blockchain for cross-border payments.

Traditional systems often involve high fees and lengthy processing times, but blockchain’s decentralized nature can facilitate faster and cheaper transactions. Moreover, the rise of central bank digital currencies (CBDCs) signifies a shift toward state-backed digital currencies, which could further enhance the efficiency of blockchain payment solutions. The blend of these technologies could lead to a more streamlined and accessible global payment system.

Impact of AI on Blockchain Payment Solutions

The intersection of artificial intelligence (AI) and blockchain technology holds immense potential for revolutionizing payment solutions. AI can enhance the security and efficiency of transactions by analyzing patterns and detecting anomalies in real-time. This proactive approach to fraud detection and risk management can significantly reduce the likelihood of breaches.AI algorithms can also optimize the transaction process through predictive analytics, enabling businesses to anticipate demand and adjust their operations accordingly.

The combination of AI with blockchain ensures not just secure transactions but also intelligent systems that learn and adapt, providing a more personalized user experience. For instance, AI can analyze user behavior to offer tailored payment solutions, improving customer satisfaction while driving operational efficiency.Furthermore, the incorporation of machine learning into blockchain systems can lead to automated smart contracts that execute transactions based on predefined conditions, minimizing the need for human intervention.

This advancement could pave the way for a new era of automated financial services, where quick decision-making is essential.In summary, as blockchain technology evolves, the integration of AI will reshape payment solutions, making them faster, more secure, and tailored to individual needs. The synergy between these technologies represents a promising frontier in the future of financial transactions.

Case Studies of Successful Blockchain Payment Implementations

The adoption of blockchain payment solutions has transformed various industries by enhancing efficiency, reducing costs, and promoting transparency. Several businesses have successfully implemented these technologies, showcasing tangible benefits and valuable lessons learned along the way. This section highlights noteworthy case studies, illustrating the impact of blockchain payment solutions on their operations.

Case Study: Overstock.com

Overstock.com, an online retailer, was one of the first major companies to accept Bitcoin as a payment method in 2014. By integrating blockchain technology, Overstock aimed to provide customers with a decentralized and secure payment option.Key takeaways from Overstock’s implementation include:

- Enhanced customer experience through diverse payment options, appealing to tech-savvy consumers.

- Reduced transaction fees compared to traditional payment methods, leading to increased profitability.

- Increased brand loyalty by positioning the company as a leader in adopting innovative technologies.

Case Study: Ripple and MoneyGram

Ripple partnered with MoneyGram, leveraging its blockchain technology to facilitate cross-border payments. This collaboration allowed MoneyGram to improve its payment processes and expand its reach internationally.Key takeaways from Ripple and MoneyGram’s partnership include:

- Real-time settlement of transactions, reducing the time and cost associated with international payments.

- Improved cash flow management through instant liquidity provided by Ripple’s On-Demand Liquidity service.

- Enhanced transparency and traceability in transactions, which increased trust among users.

Case Study: De Beers

De Beers, the diamond giant, implemented blockchain technology to track the provenance of diamonds. By using the Tracr platform, they ensured that diamonds were ethically sourced and conflict-free.Key takeaways from De Beers’ use of blockchain include:

- Increased consumer trust through transparent supply chain visibility, reassuring customers of ethical sourcing.

- Enhanced operational efficiency by automating processes and reducing paperwork associated with supply chain management.

- Strengthened brand reputation by committing to ethical business practices and sustainability.

Case Study: IBM Food Trust

IBM Food Trust created a blockchain-based platform to enhance transparency in the food supply chain. Companies like Walmart and Nestlé have utilized this system to trace the origin of food products.Key takeaways from IBM Food Trust’s implementation include:

- Rapid traceability of food products, significantly reducing the time needed to trace sources of contamination or spoilage.

- Improved food safety and quality assurance, ensuring consumers receive safe products.

- Increased collaboration among supply chain partners, fostering a culture of shared responsibility for food safety.

Case Study: BitPay

BitPay is a blockchain payment service provider that enables businesses to accept Bitcoin. By integrating BitPay, companies can streamline transactions and reduce exchange rate volatility.Key takeaways from BitPay’s impact include:

- Facilitation of cross-border transactions without the need for currency conversion, saving costs.

- Reduction of chargebacks, as Bitcoin transactions are irreversible, promoting a more secure environment for businesses.

- Access to a growing market of cryptocurrency users, expanding the customer base for businesses.

How to Implement Blockchain Payment Solutions in Your Business

Source: hrbartender.com

Implementing blockchain payment solutions can significantly enhance the efficiency and security of transactions within your business. However, the process involves several steps and considerations to ensure a successful adoption. This guide will walk you through each phase needed to integrate blockchain payment systems effectively.

Step-by-Step Guide to Adoption

Implementing a blockchain payment solution requires strategic planning and execution. The following steps provide a structured approach for businesses looking to adopt these innovative payment systems:

- Assess Your Business Needs: Begin by identifying the specific payment challenges your business faces and how blockchain can address them. Consider factors such as transaction speed, security, and cost-effectiveness.

- Research Available Solutions: Investigate various blockchain payment solutions in the market. Explore features, transaction fees, and user experiences to find a solution that matches your business goals.

- Select a Blockchain Payment Provider: Choose a provider based on reliability, technical support, and scalability. Look for providers with established track records and positive client reviews.

- Develop a Project Plan: Create a comprehensive plan detailing timelines, responsibilities, and goals for the implementation process. Make sure to include milestones for evaluating progress.

- Integrate with Existing Systems: Work on integrating the blockchain payment solution with your current accounting and inventory systems. Collaboration between IT and finance teams is crucial here.

- Train Your Staff: Provide training sessions for employees who will handle the new payment system. Familiarizing them with the technology will ensure smoother operations post-implementation.

- Launch a Pilot Program: Before a full rollout, conduct a pilot program to identify any issues in a controlled environment. Use feedback to make necessary adjustments.

- Monitor and Optimize: After implementation, continuously monitor the performance of the blockchain payment system. Gather data and feedback to optimize the system for better efficiency.

Considerations for Selecting a Blockchain Payment Provider

When choosing a blockchain payment provider, several factors should be taken into account to ensure that you select the most suitable one for your business needs:

“Choosing the right blockchain payment provider can significantly impact the success of your implementation.”

- Security Features: Prioritize providers that offer robust security measures, including encryption and multi-signature authentication, to safeguard your transactions.

- Compliance with Regulations: Ensure the provider complies with local and international regulations related to cryptocurrency and blockchain transactions.

- Transaction Speed and Fees: Evaluate the speed of transactions and any associated fees to understand the total cost implications for your business.

- Technical Support: Look for providers that offer reliable customer support and technical assistance to help resolve any issues that may arise.

- Scalability: Choose a provider that can grow with your business, ensuring the solution can handle increased transaction volumes as your business expands.

Resources and Tools for Implementation

Accessing the right resources and tools is critical for a smooth implementation of blockchain payment solutions. The following resources can help guide your journey:

“Utilizing available tools can streamline the integration process and enhance efficiency.”

- Blockchain Development Platforms: Platforms like Ethereum and Hyperledger Fabric offer development tools and frameworks for building customized blockchain applications.

- APIs and SDKs: Application Programming Interfaces (APIs) and Software Development Kits (SDKs) provided by blockchain companies can facilitate integration with existing systems.

- Consultancy Services: Consider hiring blockchain consultancy services that can provide expertise and guidance tailored to your specific implementation needs.

- Online Courses and Tutorials: Websites like Coursera and Udemy offer courses on blockchain technology and its applications, which can be valuable for training your team.

- Community Support and Forums: Engaging with blockchain communities on platforms like Reddit or Stack Overflow can provide insights and support throughout your implementation journey.

Summary

In conclusion, Blockchain Payment Solutions not only streamline payment processes but also pave the way for a more decentralized and secure financial future. As businesses and consumers alike begin to embrace these innovative solutions, the potential for growth and adaptation in the payment sector becomes increasingly apparent. By overcoming existing challenges and leveraging emerging technologies, blockchain is set to redefine how we think about transactions in the coming years.

FAQ Section

What are blockchain payment solutions?

Blockchain payment solutions utilize blockchain technology to enable secure, fast, and cost-effective transactions, distinguishing them from traditional payment methods.

How does blockchain improve transaction speed?

Blockchain technology enables faster transactions by eliminating the need for intermediaries and streamlining the verification process.

Are blockchain payment solutions secure?

Yes, they are highly secure due to the cryptographic methods used in blockchain, which protect transaction data against fraud and unauthorized access.

Can blockchain payment solutions be used globally?

Absolutely! One of the significant advantages of blockchain is its ability to facilitate cross-border payments quickly and efficiently.

What challenges do blockchain payment solutions face?

Challenges include regulatory hurdles, scalability issues, and user adoption, which can slow the widespread implementation of these solutions.